27+ How much will mortgage lend

The top 10 percent makes over 68000 per year while the. So if you earn 30000 per year and the lender will lend four times.

Total Debt Service Ratio Explanation And Examples With Excel Template

Banks and building societies mostly use your income to decide how much they can lend you for a mortgage.

. How much is the monthly payment for a 130k home paid over 27 years. It was 533 this time last week. The longer your term the less you may pay each month but youll end up paying more in interest.

The APR on a 15-year fixed is 537. The calculator will tell you how much. The Reserve Bank of Australia RBA has increased the cash rate by 05 of a percentage point.

Fill in the entry fields. Like with a traditional mortgage borrowers will typically have to pay one-time upfront costs at the beginning of the reverse mortgage loan. You may qualify for a loan amount of 252720 and your total monthly mortgage.

For this reason our calculator uses your. A typical mortgage length is 25 years. For today Tuesday February 15 2022 the average rate for a 30-year fixed mortgage is 420 an increase of 27 basis points since the same time last week.

Traditionally mortgage lenders applied a multiple of your income to decide how much you could borrow. Loan Officers Assistant in America make an average salary of 42666 per year or 21 per hour. Interest rate The bigger your deposit the better the.

Last week the average rate was 442. Based on the table if you have an annual income of 68000 you can purchase a house worth 305193. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less.

Longer terms usually have higher rates but lower. DTI Often Determines How Much a Lender Will Lend So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you based on your current financial. If I pay 27 per month how much of a mortgage loan will that be.

For today Tuesday February 15 2022 the average rate for a 30-year fixed mortgage is 420 an increase of 27 basis points since the same time. A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694. This mortgage calculator will show how much you can afford.

Were not including additional liabilities in estimating the income. If true a couple who earn a combined annual salary of 100000 can afford. Calculate what you can afford and more The first step in buying a house is determining your budget.

That means the cash rate is now 235 per cent. To afford a mortgage loan worth 360k you would typically need to make an annual income of about 100k and be able to afford monthly payments worth 2000 and upwards. 2 days agoTodays rate is higher than the 52-week low of 462.

If youre on a variable rate. Find out how much you could borrow. A 15-year fixed-rate mortgage of 100000 with.

The calculator will tell you how much the loan. This finance video tutorial explains how to calculate how much of a monthly mortgage loan payment goes to the bank through and how much goes into paying off. If I pay 3000 per month how much of a mortgage loan will that be.

Enter the monthly payment the interest rate and the loan length in years. Common mortgage terms are 30-year or 15-year. A mortgage loan term is the maximum length of time you have to repay the loan.

51 Adjustable-Rate Mortgage Rates. Some experts suggest that you can afford a mortgage payment as high as 28 of your gross income. Enter the monthly payment the interest rate and the loan length in years.

A slightly lower multiple. Currently the average interest rate on a 51 ARM is 453 up from the 52-week low of 411.

Download Payment Agreement Template 20 Payment Agreement Agreement Credit Card Infographic

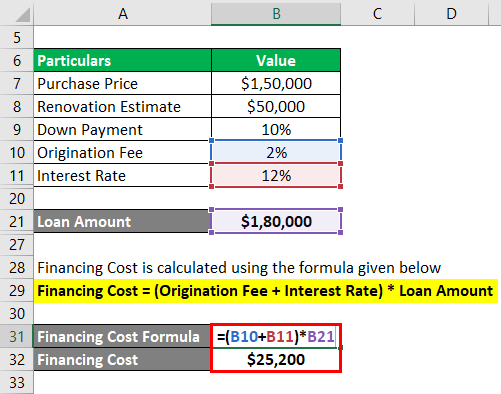

Hard Money Loan Complete Guide On Hard Money Loan With Example

Trust Letter To Mortgage Lender Business Letter Template Letter Templates Free Reference Letter

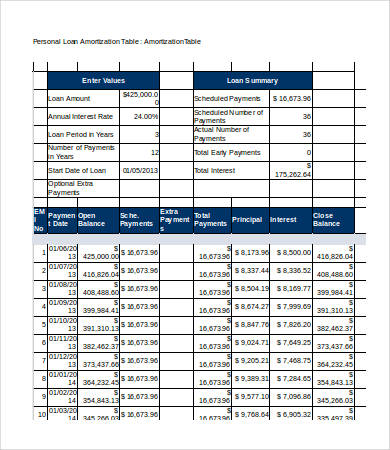

Amortization Tables 4 Free Word Excel Pdf Documents Download Free Premium Templates

Mortgage Pre Approval Letter How To Write A Mortgage Pre Approval Letter Download This Mortgage Pre Approval Letter Preapproved Mortgage Lettering Mortgage

Credit Card Processing Proposal Template How To Plan Proposal Templates Event Planning Quotes

Barclays Bank Statement Template Mbcvirtual In 2022 Statement Template Bank Statement Apply For A Loan

Free Printable Promissory Note Promissory Note Notes Template Templates Printable Free

Supplemental Agreement Template Contract Template Contract Agreement Service Level Agreement

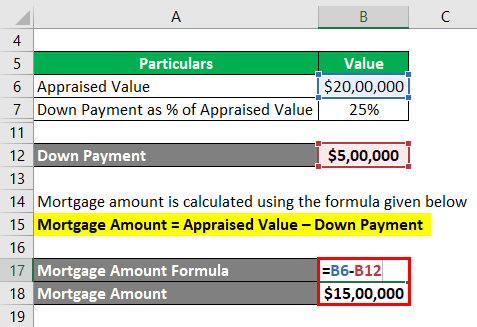

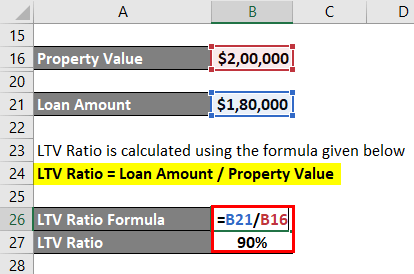

Loan To Value Ratio Example Explanation With Excel Template

You Can See This New Request Letter Format For Degree Certificate At New Request Letter Format For Degree Certificate For Lettering Cover Letter Template Loan

Pin On Statement Template

Credit Card Processing Proposal Template How To Plan Proposal Templates Event Planning Quotes

Mortgage Employment Verification Form How To Create A Mortgage Employment Verification Form Download This Mort Templates Employment Mortgage Loan Originator

Hard Money Loan Complete Guide On Hard Money Loan With Example

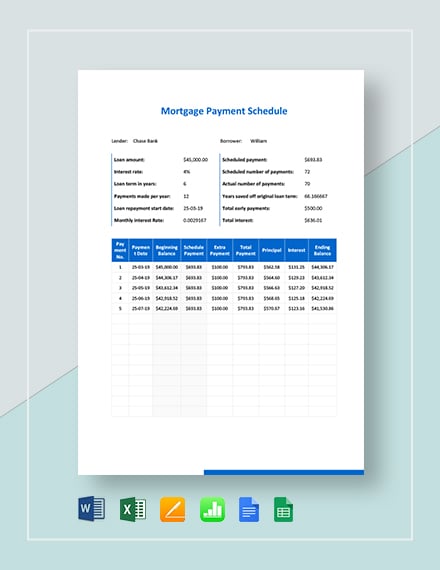

Mortgage Payment Schedule 5 Free Excel Pdf Documents Download Free Premium Templates

Cover Letter Template Ymca Resume Summary Examples Academic Cv Cover Letter Template